Buying leasehold property – what you need to know

Leasehold update – the Leasehold and Freehold Reform Act was passed in 2024 but has not yet come into effect.

Click here to read the Latest News on Leasehold Reform

As well as having a senior partner who is also a property investor and developer, here at Bonallack and Bishop we have 22 people in our Property Department. And one of the most common questions we get asked relates to leases of residential flats.

Click here to read more about our specialist property investor team.

So here is a list of just some of the things you need be aware of when buying any leasehold property. But before we go through the list, one very, very simple piece of advice.

READ YOUR LEASE

Why?

The answer to most lease related questions property is usually contained in the lease itself.

Make sure that you know the right questions to ask when buying a leasehold flat

So, when you’re buying a leasehold flat, please make sure you read the lease and that you understand exactly what it means. If there’s anything you don’t fully get, and there probably is because these kind of leases are complicated – just ask your solicitor. That’s what they’re there for and exactly what you are paying them for.

And remember that leasehold is fundamentally different to freehold when it comes to property ownership. In fact it can be argued that leaseholders don’t actually own their property. They just buy the right to live there for whatever time period is stated on the lease, subject to some conditions.Depending on the terms of the lease, they will probably have to get the permission of the freeholder if they want to make certain structural amendments or improvements to their property.

For a free no strings attached conveyancing fee quote for your new leasehold flat, call our team now on FREEPHONE 0800 1404544.

1. Every lease is different

We are talking here about long leases – not short leases because most ASTs (assured short hold tenancies – the standard lease for short leases of six months or more) are pretty standard. Long leases are those you buy, and which were originally granted for over 21 years – usually 99 years or 125 years

2. Most restrictions and obligations will be non-negotiable.

So don’t put an offer in to buy a leasehold property in the hope that you’re going to get the freeholder to change an awkward term or two in your lease – though a redrafted lease may be possible if you’re negotiating a lease extension (see below for more about extending a lease)

3. Watch out for service charges when buying leasehold property

· There are some people out there who argue that leasehold flats should be avoided at all costs just because of the service charge. But bear in mind that just because there is a service charge doesn’t mean you shouldn’t buy a flat.

Remember – a service charge does what it says on the tin – it’s a charge for services.

And often the biggest part of any service charge is for maintenance of the building’s structure and common parts – stairs, lifts, roof, garden, car park – the list goes on.

Don’t forget, many of these are things you would still have to pay if you bought a house instead. and sometimes they also include additional amenities which should never find in a house – like a gym, caretaker or concierge. In fact service charges do have one hidden benefit – they make many of these costs more predictable and you pay a regular sum every month.

NB the downside for many people is that you don’t have control over those service charges can sometimes prove unnecessarily expensive

· Watch out for future expenditure. When buying a leasehold property, make sure your solicitor asks, “are there any planned major works?”

· In particular keep an out for any service charge dispute that’s already going on when you buy the property

· Double check, if there is a so-called “sinking/reserve fund”, whether the vendor is going to want a percentage of that returned on completion?

Click here to read more about leasehold property sinking funds

4. Your right to a lease extension

This is something that surprisingly few people, including many conveyancing solicitors and estate agents, really understand.

Although there are some restrictions, in general terms your statutory right to a lease extension means that anyone who owns a long leasehold flat can force the freeholder to grant them another 90 years on the lease – for a price, of course.

This right is becoming increasingly important as lenders tighten their mortgage criteria. Any remaining lease term below 70 or 75 years these days will seriously restrict available lenders.

Lease extension and freehold purchase have a number of dedicated pages on this site of their own – but 2 key points you do need to know in thinking about extending your lease

1. If you are buying a short lease flat, you no longer need two years ownership before your solicitor makes an application for a section 42 lease extension on your behalf. That requirement was abolished on January 31, 2025

2. Secondly the moment your lease drops below 80 years, the premium you will need to pay to extend your lease rises significantly – usually by thousands of pounds.

We have a specialist five strong leasehold team deal with nothing but lease extension, right to manage and enfranchisement. And was happy to provide FREE initial phone advice.

Click here to find out more about lease extension

5. Your right to buy your freehold

The legal right to join together with some of your fellow leaseholders in your block to buy the freehold is known as enfranchisement.

Again we have a series of dedicated pages on this website about freehold purchase.

But the first thing you need to know is that at least half of the leaseholders will need to come together to jointly buy the freehold. And although that can be quite straightforward with very small blocks, it can become a major practical hurdle with larger blocks.

But enfranchisement does transfer ownership of the building to you and the other participating leaseholders. Which allows you to grant yourself a 999 year lease and take over responsibility for block management.

Click here to read more about leasehold enfranchisement

Or click here to find out more about the differences between extending your lease and buying your freehold

6. Buy to let? Make sure that there is no tenant breach of your own lease

If you are buying a flat to rent out, then you will need to ensure that your AST includes a clause that your tenant must comply with conditions of any head lease. If not, you can find yourself in breach of your own lease through no fault of your own. This is just one of the many reasons why buy to let landlords shouldn’t risk a DIY lease, or download a generic online lease

7. Restrictions in your lease (i) – Occupation

Some leases contain restrictions to “single family occupation” or “tenant and his immediate family”. These are common in older leases and went out of fashion for a while. They seem to be becoming a bit more common.

Watching out for these kind of restrictions is particular important if you’re planning on using the property for an HMO (house of multiple occupation i.e. house share), or even a single let to more than one person who are not in a relationship

8. Restrictions in your lease (ii) – Subletting

This is even more fundamental if you are buying a buy to let. Some leases have a restriction on subletting.

Can you get round that? That depends.

Surprise, surprise – you need to read the lease. If there is an outright restriction you probably have a problem – but there may simply be requirement for the freeholder’s consent, or you might need to serve a notice on them – and there may also be a fee payable. But do carefully check the wording of your lease on this particular point if you’re thinking of subletting – because you might discover that your freeholder can simply withhold that consent

9. Restrictions in your lease (iii) – Dealings

Fortunately, these kind of clauses tend to be rarer – but they do exist. You may be surprised to find that on dealings could limit who you are permitted to sell your flat to. A classic example is retirement flats, which often have very restrictive dealings clauses. There is currently no legal restriction on a clause limiting ownership of retirement flats to only to those over a certain age e.g. 55.

But even if there’s not an outright restriction, you may find your lease contains a requirement for notice and a fee on every dealing? What’s more, in some leases, the freeholder is permitted to charge administrative fee for answering pre-contract enquiries!

Also watch out for any restriction on dealings where there is existing breach of the lease.

10. Restrictions in your lease (iv) – Alterations

These kind restrictions are surprisingly common. Some alterations to leasehold property requires the freeholder’s absolute consent – others simply require a fee. These kind of clauses are particularly common if you are looking at any structural changes (e.g. removing or knocking through a wall) or changes to the outside of your block – e.g. replacement windows

11. Restrictions in your lease (v) – Regulations

This is perhaps one of the worst clauses of all. Watch out for any clause allowing your freeholder to make “reasonable” additional regulations. That kind of clause is dangerously vague and could cause real problem is in the future – not to say nasty legal bill if a dispute arises.

12. Is capital growth better for houses than flats?

There are some people who reckon you should never touch leasehold flats and argue that the capital growth is much better for houses. That of course, may not be relevant to you.

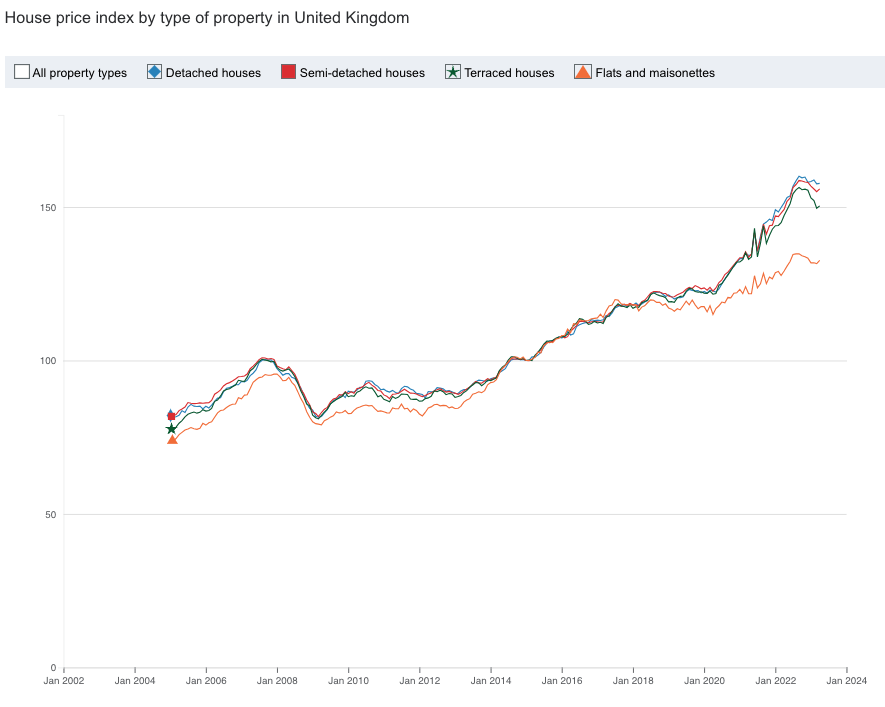

But if future increases in the value of your property is important to you, here they really interesting graph from Property Hub, comparing the increase in values in a number of types including houses and flats/maisonettes.

But if future increases in the value of your property is important to you, here they really interesting graph from Property Hub, comparing the increase in values in a number of types including houses and flats/maisonettes.

And as the graph shows, for many years, these 2 types of property had, broadly, increased in price at the same rate for many years. But there’s a huge variation around 2020.

Why? You can’t be sure, but it’s likely that the difference is related to Covid, and people’s wish during the pandemic to have more space and potentially access to a garden or other open space.

Hope you found that useful – let me know if there any other legal questions or practical tips you’d like relating to property investment.